Why Invest in Cash Funds with Webull?

Investing in cash funds with Webull allows clients to earn interest with their idle cash.

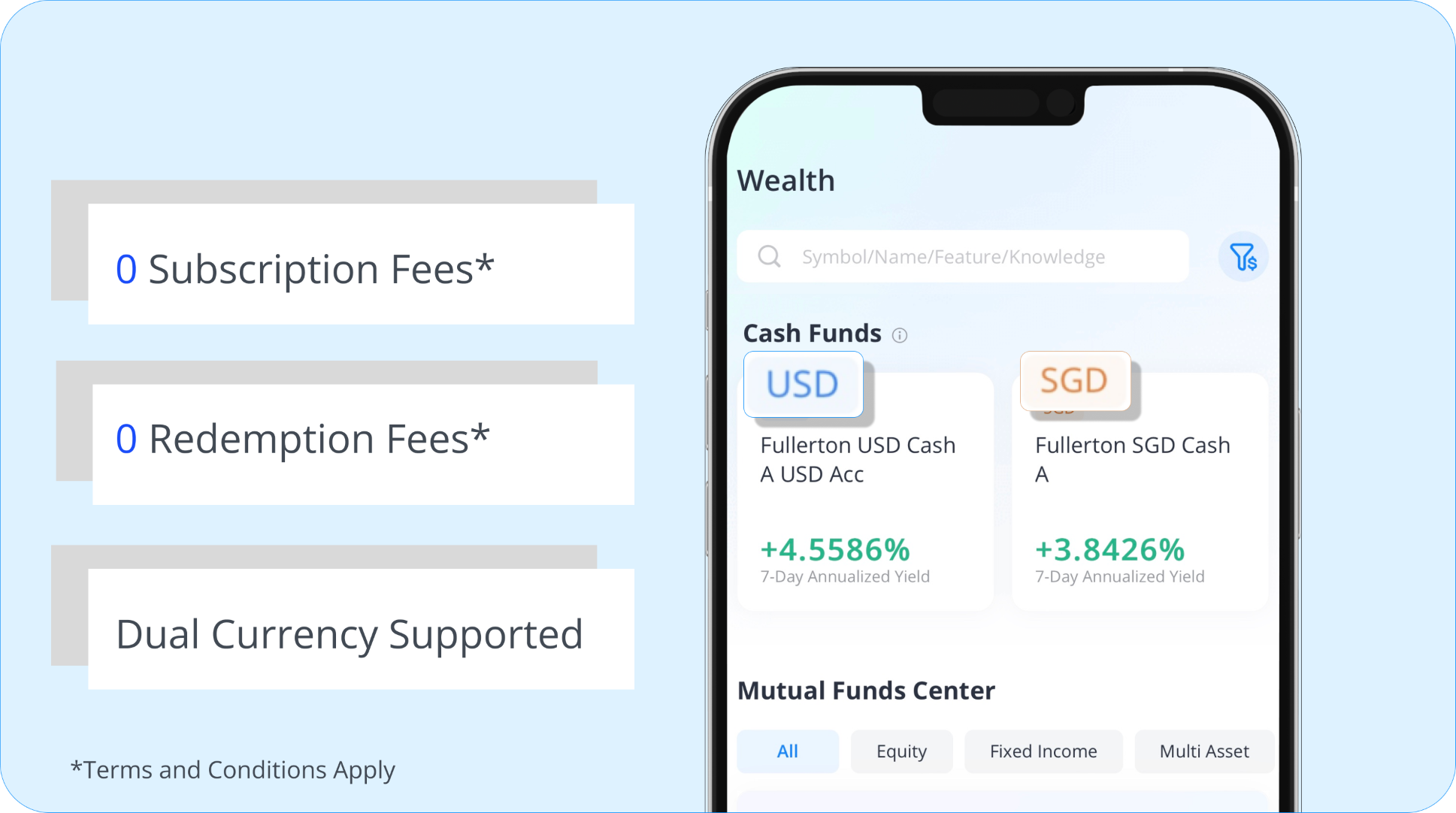

Also, there are no subscription or redemption fees* when investing in cash funds with Webull.

Investors can invest in USD Cash Fund $Fullerton USD Cash A USD Acc and SGD Cash Fund $Fullerton SGD Cash A in the Webull APP-Wealth Page, bringing great flexibility. Click here to find more funds>>>

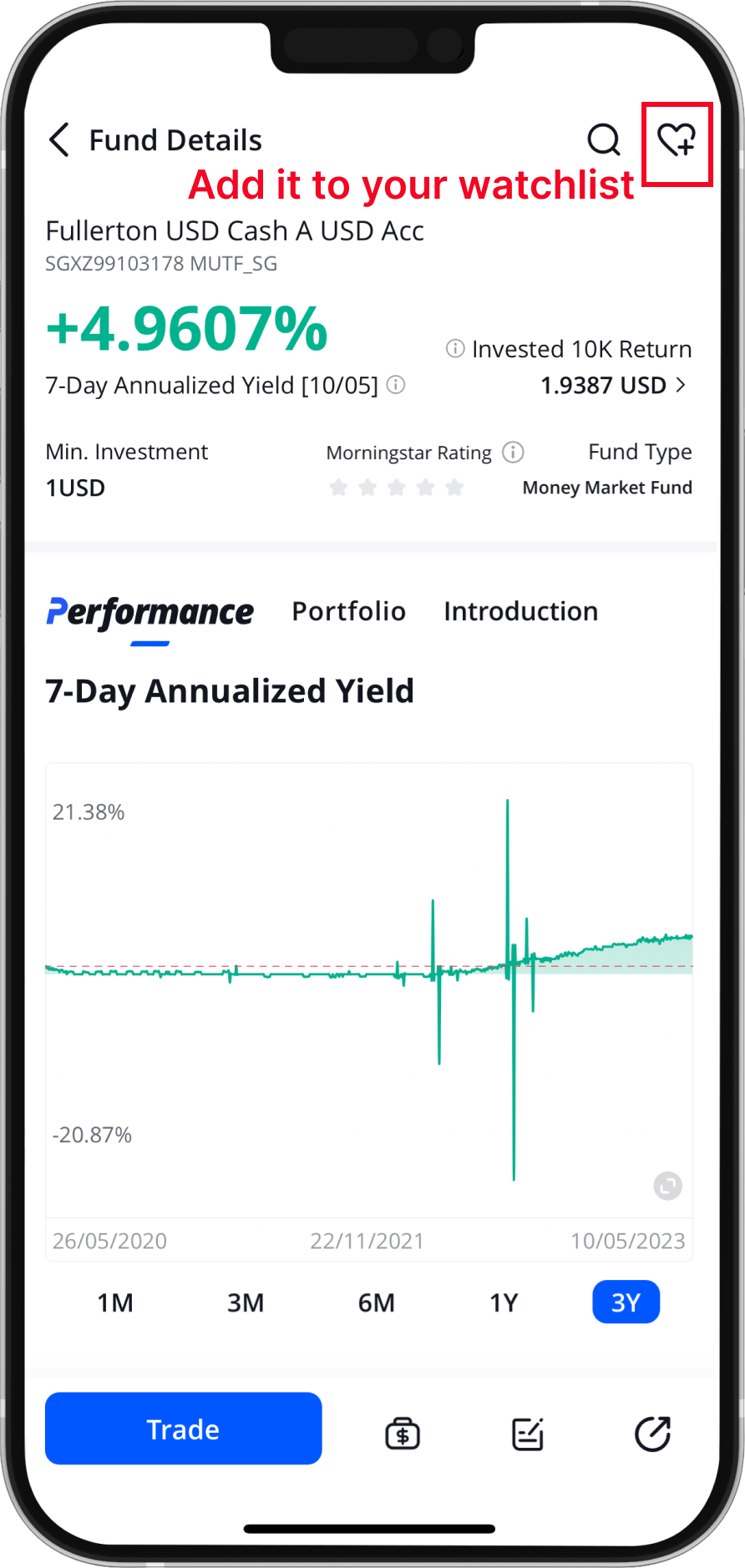

If you are interested in Cash Funds, do not hesitate to access their detail page and add them to your watchlist to monitor their subsequent performance.

Advantages of investing in Fullerton USD and SGD Cash Fund with Webull

1. Invests in SGD and USD deposits with MAS-licensed financial institutions with short-term investment grade rating1.

2. Due to scale and as an institutional investor, Fullerton has access to a comprehensive list of banks, potentially better rates, and price discovery.

3. Placement periods are managed dynamically to respond quickly to interest rate movements.

4. The fund offers daily liquidity.

5. T+1 quick settlement during redemption.

6. Immediate availability of buying power in our Webull app during redemption.

7. Reasonable fees2: The management fee of the Fullerton SGD Cash Fund has been capped at 0.10% p.a. since June 2012, and for Fullerton USD Cash Fund, capped at 0.12% p.a.

8. Investors are recently attracted to higher returns corresponding to rising interest rates.

1Or Singapore-licensed banks permitted under CPFIS to accept fixed deposits.

2Information is accurate as of 27-Apr-23

Other factors you may be concerned about

1. How is Fullerton able to obtain more favorable rates than T-bills?

Fullerton can obtain better rates and terms due to its scale and access as an institutional investor. It also has an efficient price discovery mechanism with daily rate runs from more than ten banks.

Another key advantage is that the funds are actively managed: By keeping maturity short, the funds’ returns are generally more responsive with [GT1] rising rates. Fullerton can also lock in prevailing rates should it expect rates to decline. Another benefit is that the fund can access MAS bills auctions.

2. Is my money safe?

Fullerton has established contact points with Singapore-registered financial institutions and manages its counterparty risk actively, and has not encountered any bank default since the funds’ launches. Fullerton’s scale gives it access to multiple bank counterparties, allowing the funds to diversify their counterparty risk. The funds also adhere to the Code on Collective Investment Scheme (CIS), which requires a particular minimum rating standard on all financial institutions the funds work with.

*Terms and Condition apply.

Disclaimer: All investment involves risks and are not suitable for every investor. Past performance is not indicative of future performance. The recommendation is only intended for general circulation and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. It is your responsibility to seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs of the recommendation before making a commitment to purchase the investment product.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

All Comments