Should I subscribe to a Regular Savings Plan for Mutual Funds or Exchange Traded Funds (ETFs)?

Four key facts on the benefits

1. Diversification:

Both mutual funds and ETFs offer the advantage of diversification, allowing investors to spread risk across various assets.

Regular savings plans enable individuals to accumulate shares over time, further enhancing the diversification benefits.

By consistently investing a fixed amount, investors can gradually build a well-diversified portfolio, reducing their exposure to any security or market sector.

2. Systematic Investing1:

Regular savings plans provide the benefit of systematic investing, allowing individuals to invest a fixed amount at regular intervals, regardless of market conditions.

This strategy, known as dollar-cost averaging, helps mitigate the risk of making investment decisions based on market timing.

By investing regularly, investors buy more shares when prices are low and fewer when prices are high. Over time, this disciplined approach can reduce the impact of short-term market volatility and smooth out the overall cost of investing.

3. Affordability:

Regular savings plans make investing more accessible to a wider range of individuals. Both mutual funds and ETFs allow investors to start with small investment amounts, sometimes as low as a few dollars per month. This affordability factor is particularly beneficial for individuals who want to start investing but may not have enough capital to invest upfront. Regular savings plans enable gradual wealth accumulation over time, making long-term investing goals more achievable.

4. Cost Efficiency:

Regular savings plans in ETFs often have lower expense ratios than mutual funds. ETFs typically follow a passive management style, resulting in lower management fees. Additionally, ETFs can be traded at market prices throughout the day, eliminating any potential premiums or discounts associated with mutual funds' end-of-day net asset value (NAV) pricing. Lower costs can significantly impact long-term returns, allowing investors to keep more investment gains.

Highlights of Key Features between Mutual Funds and ETFs

Please note that while this table provides a general overview, it's important to conduct thorough research and consider specific fund or ETF offerings before making any investment decisions.

Finally, a Regular Savings Plan in mutual funds and ETFs offer several benefits to investors. Regular savings plans can help individuals build wealth over time and achieve their long-term financial goals by providing diversification, systematic investing, affordability, and potential cost savings. Investors must assess their risk tolerance and investment objectives and carefully evaluate specific mutual funds or ETF offerings before initiating a regular savings plan.

1 https://www.investopedia.com/terms/s/systematicinvestmentplan.asp

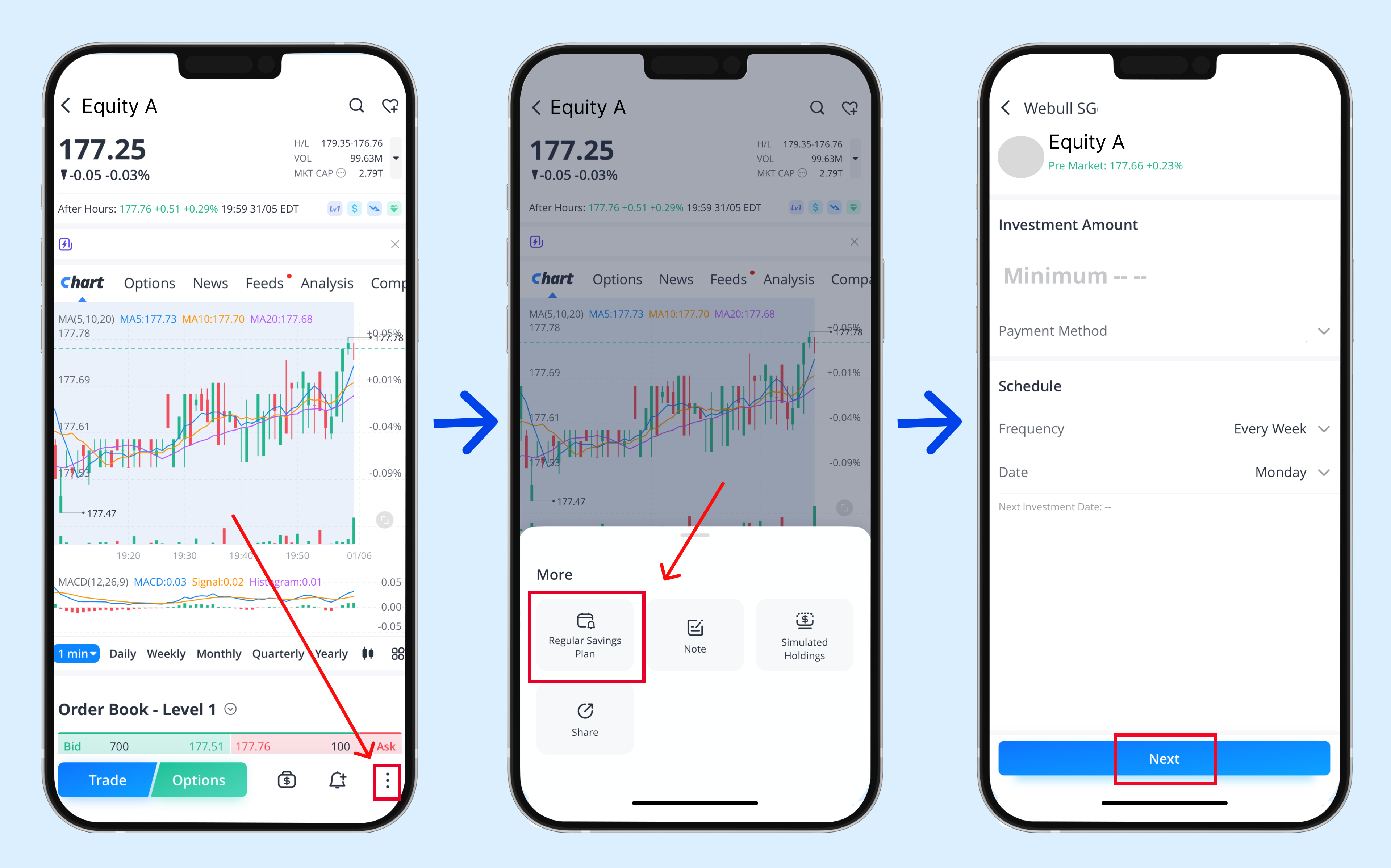

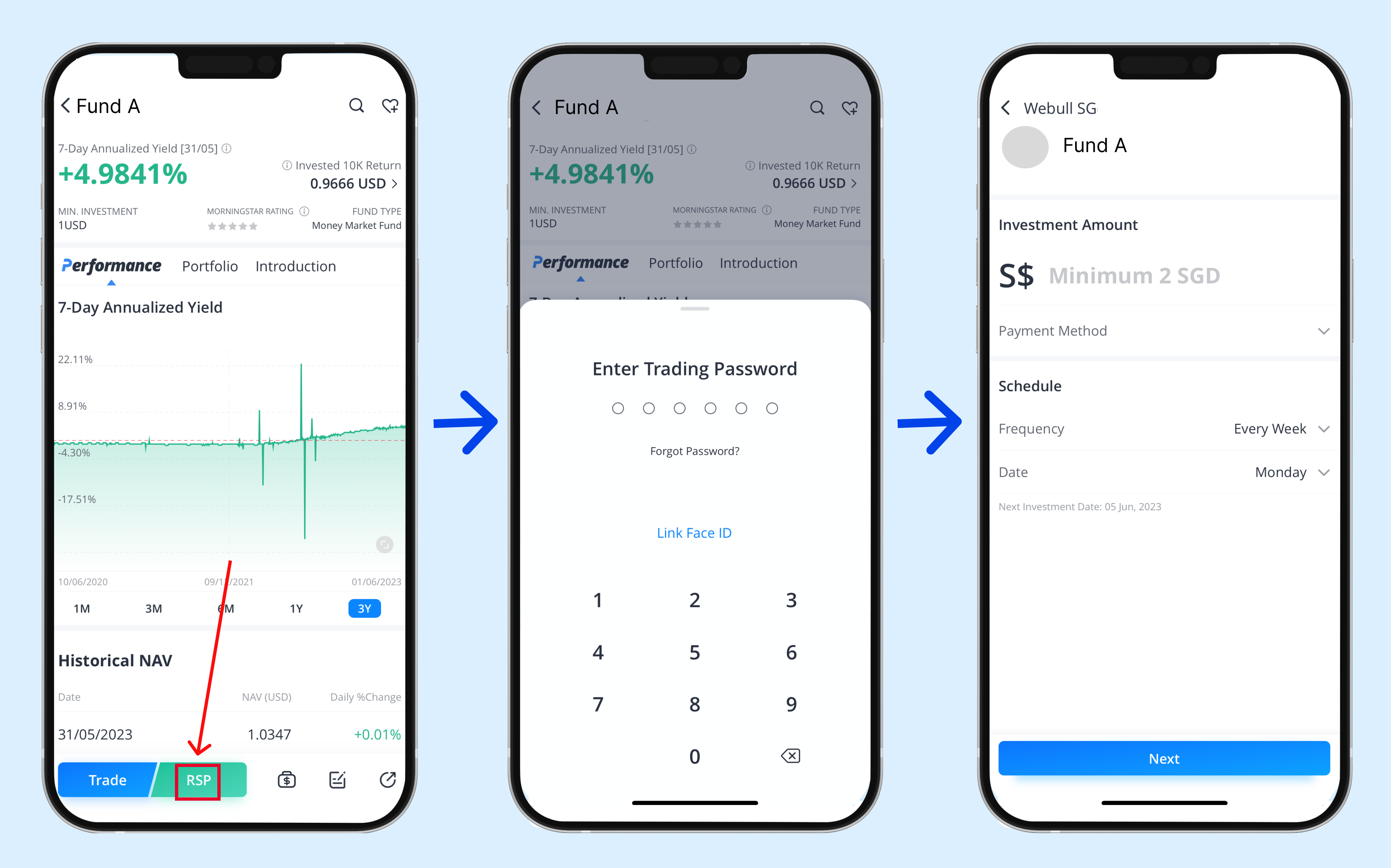

How to customize your own Regular Savings Plan at Webull?

For US stocks/ETFs: RSP card or 3 dots button at Individual Stock Details Page>RSP

For Mutual Funds: RSP button at Mutual Fund Details Page

Click to set up your RSP for Mutual Funds>>>

Just set it up and enjoy your investing at Webull!