How to Utilize Webull 0DTE Options Center?

In the previous article “Triple Witching Day June 2024: Insights and Actions”, we have discussed about the Triple Witching Day phenomenon. On triple witching day, there are usually increased trading volume and market volatility when a large number of contracts expire on the same day. Webull 0DTE Options Center offers a visual tool and real-time data for investors and traders who plan to trade 0DTE options on that day. So how do we get started with trading 0DTE Options ?

Preparation beforehand: Webull 0DTE options center can help

If you are an options trading enthusiast, then Triple Witching Day will be one of the most important dates in the quarter for you to watch. With Triple Witching Day near the corner, expiring options can be a popular product to trade. By leveraging trading tools, investors can better position themselves to take advantage of the opportunities or safeguard against potential pitfalls during Triple Witching Day. The Webull 0DTE Options Center, with its comprehensive and up-to-date data, is particularly suited for this task, offering insights that can help traders make informed decisions during these turbulent trading periods.

Webull 0DTE Options Center offers a corner dedicated to 0 Days To Expiration (0DTE) Options, helping investors and traders track options expiring on the same day of trading.

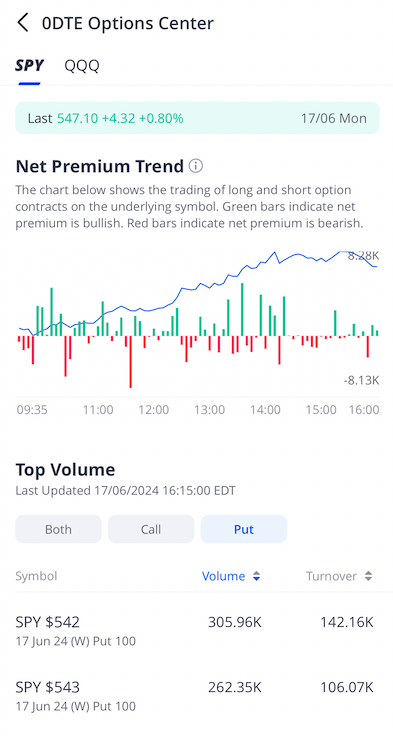

The 0DTE Options Center has two sections “Net Premium Trend” and “Top Volume”.

Figure 1: Screenshot of Webull 0DTE Options Center

Disclaimer: Image is for illustrative purposes only. Not financial advice.

If you would like to try out the 0DTE Options Center, just open your Webull App and visit “Markets – Discover – Options Center – 0DTE Options Center” to learn more about it.

Section One: Net Premium Trend

The chart depicts the "Net Premium Trend," which is calculated as the turnover from bullish transactions minus the turnover from bearish transactions[1], illustrating real-time options turnover data. This metric captures the total value of executed options transactions within specific 5-minute intervals from 09:30 ET to 16:00 ET, encompassing both call and put options related to the underlying symbol. The resulting "net premium trend" is visualized with green bars indicating bullish trends and red bars indicating bearish trends, offering insights into market sentiment throughout the trading day.

Alongside these bars, the chart displays a blue line tracking the price movement of the underlying symbol over the same time frame. The maximum and minimum values on the right side of the chart represent the highest and lowest points of the net premium trend observed between 09:30 ET and 16:00 ET, providing additional context on sentiment shifts and market dynamics throughout the trading session. Together, these elements provide traders and analysts with a comprehensive view of both options market sentiment and underlying asset price action during the trading day.

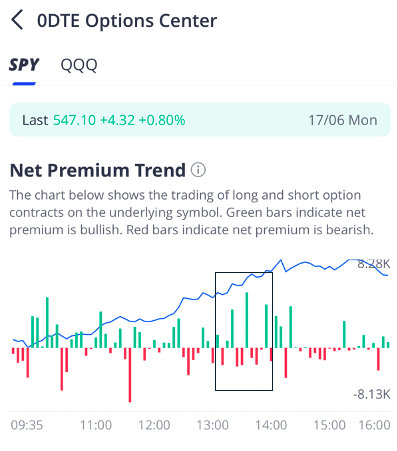

Figure 2: Section One in Webull 0DTE Options Center: Net Premium Trend

Disclaimer: The image is for illustrative purposes only. Not financial advice.

[1] Bullish transaction means buying calls and selling puts, and bearish transaction means the opposite behaviour. The “net premium trend” bars indicate whether there are more bullish transactions or more bearish transactions in the market every 5 minutes.

Based on the example above, as of 16:00 ET on a trading day, there are 78 bars on the chart: 39 green and 39 red. To narrow down the time frame, during 13:00 ET and 14:00 ET, the total heights of the 5 green bars were greater than the total heights of the 7 red bars, and this visually indicates that investors held a more bullish view between 13:00 ET and 14:00 ET.

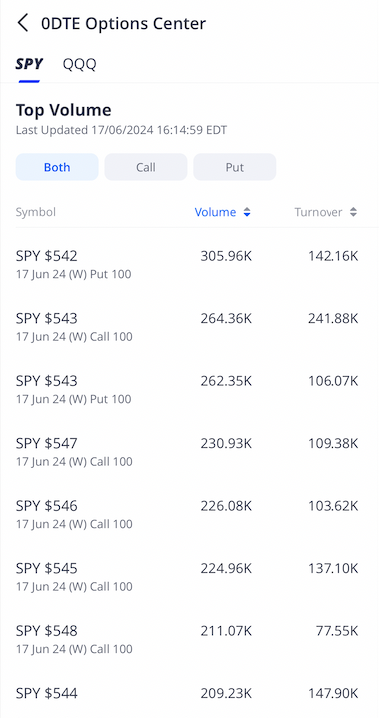

Section Two: Top Volume

The “Top Volume” section displays a wide range of timely updated options statistics for contracts on an underlying symbol.

Figure 3: Section Two in Webull 0DTE Options Center: Top Volume Portrait View.

Disclaimer: The image is for illustrative purposes only. Not financial advice.

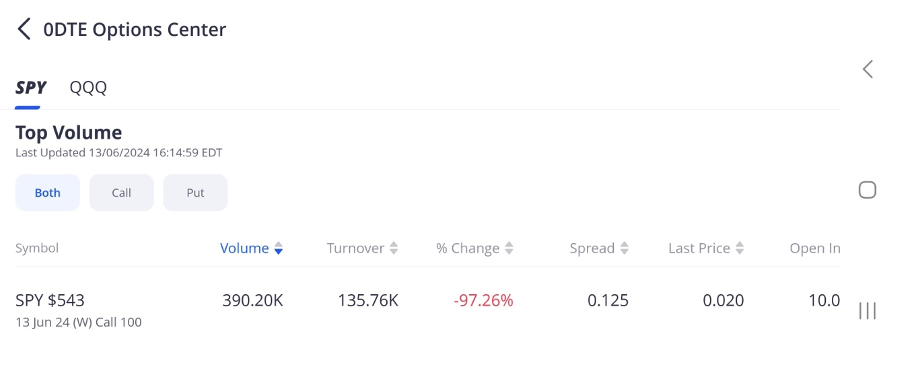

Figure 4: Section Two in Webull 0DTE Options Center: Top Volume Landscape View.

Disclaimer: The image is for illustrative purposes only. Not financial advice.

From Figure 4, several predefined indicators such as volume, turnover, % change, spread, last price, and open interest allow investors to assess which options are heavily traded or more liquid. In our description, we will emphasize three key components: (1) Volume (2) Turnover and (3) Open Interest.

Volume represents the total number of option contracts traded within a specific period, while turnover signifies the total monetary value of all executed options transactions. Open interest, on the other hand, indicates the number of option contracts traded but not yet closed from 09:30 ET to the current time.

Open interest holds significant importance in options trading as it reflects the number of contracts that have been bought or sold but not yet offset by a closing transaction. High open interest indicates active participation in that particular option, suggesting liquidity and potentially tighter bid-ask spreads. Moreover, it demonstrates market interest and confidence in the underlying asset's future price movements.

Given the imminent expiration of 0DTE options, investors face the risk of them being exercised. Opting to trade options with high trading volume, turnover, or open interest can mitigate this risk since they are more likely to be liquidated before expiration.

Investors can further evaluate options by considering trading volume alongside the strike price and the underlying symbol's last price. Options that are slightly out-of-the-money yet heavily traded might present profitable opportunities. Fluctuations in the underlying symbol's price could potentially move these options into profitability by expiration. Out-of-the-money options typically carry lower premiums compared to in-the-money options, which can make them attractive for trading strategies focused on price movements.

Summary

Webull 0DTE Options Center offers a strategic approach that empowers investors to navigate the options market effectively. Investors can leverage insights from trading activity, open interest, and price dynamics in the 0DTE Options Center to make well-informed decisions.

Reference:

1. https://www.investopedia.com/trading/options-trading-volume-and-open-interest/

![]()

All Comments