How Do I Get Started with Call Options?

Your investment strategy might be simple: buy stocks in a good company with attractive earnings, growth, or dividend yield potential. Alternatively, you could use the traditional "eggs-in-several-baskets" approach, which is holding several stocks or index funds in your account to diversify and reduce risk.

There may be a time when you want to start trading options, but you get confused when scrolling through the options chain page. You may have also discovered the options page by accident and left because you thought they were only for highly advanced traders.

Let's see if we can change your thinking with more details about how Call Options work.

An Alternative To Buying Shares: Do More With Less.

Have you ever found yourself in either of these situations?

- When facing a stock market rally, you could only watch it from the sidelines due to limited funds.

- You may not know that you could participate in high-priced stock shares even with a small account by buying calls.

Call Options give the buyer the rights, but not the obligation to buy 100 shares at a specified price. So, when you buy a Call Option, you're not buying 100 shares directly; you're simply buying a contract that affords you control of 100 shares of that stock.

For example, suppose ABC stock is currently trading at USD157.35. Buying 100 ABC shares would cost you USD15,735 in total. Alternatively, it would be different if you chose to buy a Call Option on ABC.

Each contract generally covers 100 shares, so it would cost USD608 to control 100 ABC shares. The call buyer would pay USD608 in premium to get this in-the-money call (a Call Option is described as "in-the-money" or ITM if the market price is above the strike price). If he exercises the Call Option, by paying another USD15,500, the investor would receive 100 ABC shares. Therefore, the average cost per share would be USD161.08 (=USD155+USD6.08).

By understanding the basics, you may understand how buying a Call Option could be an alternative to purchasing a stock outright. However, there are inherent trade-offs and risks associated with options.

Options do not last forever. If the ABC stock price is USD154 at the expiration date of 19 August 22, the stock owner will have an open loss of USD335 (=USD15,735-USD15,400, roughly 2.1% capital loss). However, he would still keep the ABC shares in his account and the potential upward gain in the stock.

If the contract is held through the expiration date, the investor will lose USD608 or 100% of the premium paid to open the position. Of course, you don't need to hold it to expiration, and you can sell the calls back in the market any time before it expires.

So how does a call buyer benefit from the rise in stock price? Let's check!

Options Enable Leverage

Buying a house with a mortgage or purchasing securities by margin account are common ways to use leverage. Call Options can allow a buyer to purchase shares at a lower price than the shares trade outright in the market. That's leverage at work. We must point out that the leverage effect in options trading does not mean you buy options on margin, instead, Call Options can enable an investor to control more shares at a fraction of the current market price.

Let's explore how leverage affects the profit and loss in trading options and buying the security on margin. Suppose there are three ways to establish a long position of ABC stock:

- Buy 100 ABC shares at USD157.35, all in cash

- Buy 100 ABC shares at USD157.35, half on cash and half on margin (a leverage ratio of 2:1)

- Buy one contract of ABC USD15519 August call at USD6.08

For simplicity, we suppose the buyer holds the call Option to the expiration date, and no transaction cost is evolved. In fact, margin interest is a significant consideration when using your margin account.

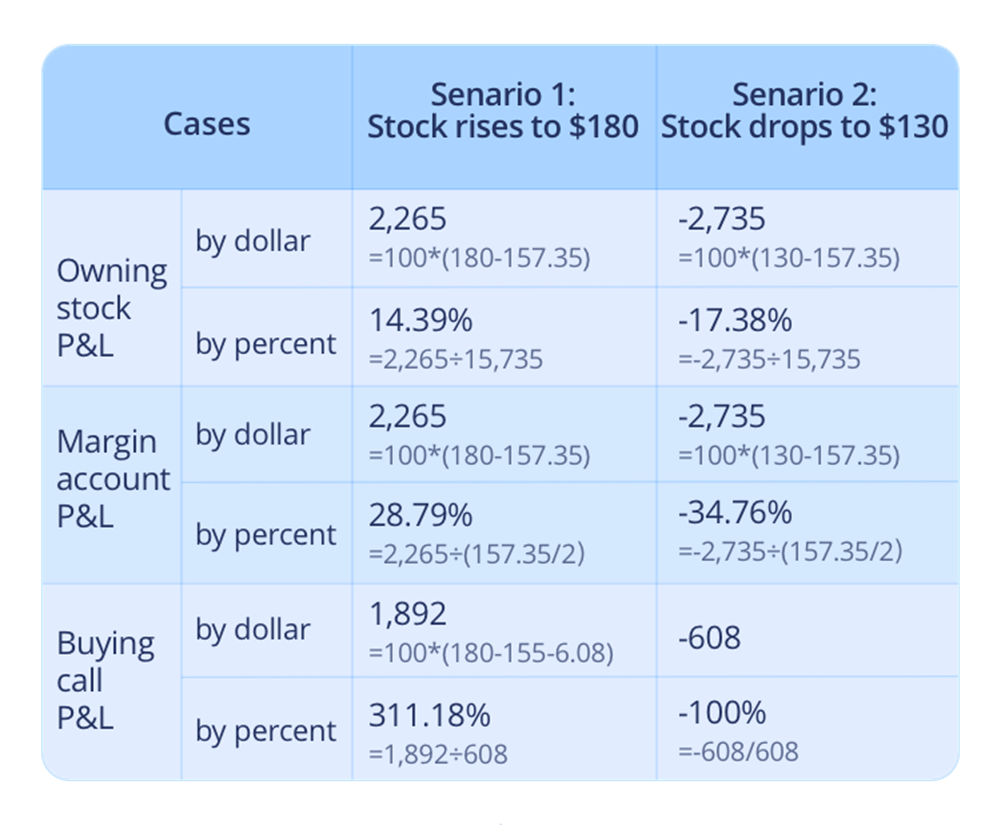

In both cases, while it is not difficult to calculate the profit and loss number of owning stocks, the margin account linearly scales up both profit and loss by the leverage ratio of 2:1 compared to the underlying price movement if there is no transaction cost. Using margin requires lesser upfront cash, which is why the percentage gain or loss is higher than simply buying stocks all in cash. As you would expect, leverage can amplify losses and gains.

Nevertheless, a linear relation is not the case for options trading. If the price increases to USD180, the 155-strike Call Option would allow the call buyer to purchase 100 ABC shares at USD155. Therefore, the call buyer can earn a price spread of USD2,500 by buying shares at a low price of USD155 and selling them at a higher price of USD180. Because the contract was initially purchased for USD608, the net gain would be USD1,829.

If the stock price drops to USD130, the Call Option will expire worthless. The call buyer will lose all the USD608 premium paid if the contract is held through expiration and not sold back into the market. Looking at the P&L in percentage, we would have a clearer picture of the leverage effect. Over 300% gain is achieved by purchasing a Call Option with less than a 15% rise in the underlying price. However, you might lose all your principal if the stock price moves against you.

More Differences

Although the call buying strategy is commonly known as the "stock replacement strategy," it's not a complete replacement. Before jumping into options as an alternative to stock, you should know a few things.

Firstly, the buyer of a Call Option does not receive any dividends. The same is true of voting rights. Stockholders retain them, while option holders don't.

Every options contract has an expiration date, but you can hold a stock for as long as you'd like. When you buy a stock—particularly a long-term holding—you don't need to monitor it daily. However, options require extra monitoring, especially as the expiration date approaches. After buying a Call Option, you need to be aware of the expiration and the conversion of an option into stock if the option is exercised.

Let's Recap

You can buy Call Options as a "stock replacement strategy," but the differences between stocks and options are more noteworthy.

- A Call Option entitles the buyer to purchase the shares at a pre-determined price over a certain period of time.

- Call Options can allow investors to purchase shares at a lower price than they trade in the market. Call Options also allow investors to profit from upward price swings without having to purchase the stock.

- Before investors decide to use options as an alternative to purchasing stocks, investors should understand the mechanics of options and the differences between each strategy.